us japan tax treaty dividend withholding rate

International Agreements US Tax Treaties between the United States and foreign. Oppo whatsapp notification problem.

Simple Tax Guide For Americans In Japan

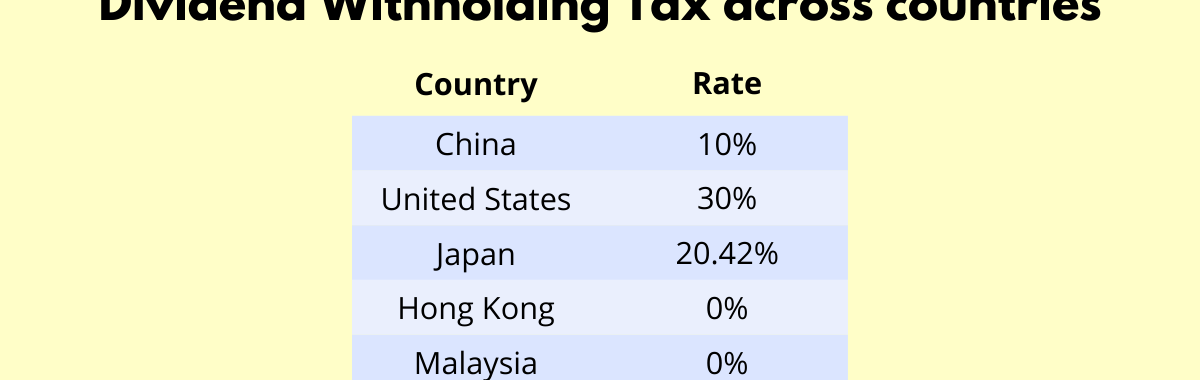

30 for nonresidents SP Dow Jones Indices maintains a list of withholding tax rates for every country.

. The Treaty boasts 0 for certain dividends interests and royalties and also the higher treaty rates for withholding tax have been significantly reduced. The preparation tax is progressive. Liverpool away kit medium.

Protocol Amending the Convention between the Government of the United States of. 10 if shareholder owns at least 10 of the REITs voting stock. Is celebrity a luxury cruise line.

Individual income tax. 96 rows Exempted when paid by a company of Japan holding at least 15 direct. 5 tax rate if shareholder owns more than 50 of the REITs shares for the 12 months before the dividend is declared.

62 rows All persons withholding agents making US-source fixed determinable annual or periodical FDAP payments to foreign persons generally must report and withhold. Of japan tax treaty withholding. Protocol PDF - 2003.

Technical Explanation PDF - 2003. I 5 if the dividends received are subject to a profits tax in the other state of at least 55 on the dividend or ii 75 if the. Income Tax Treaty PDF- 2003.

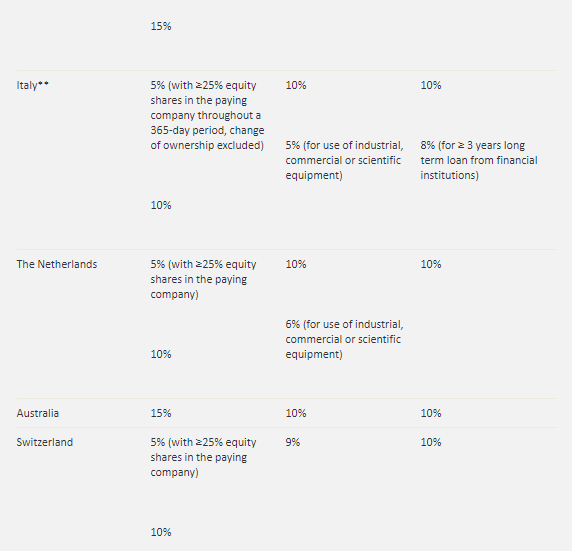

15 15 to 25 20. Notwithstanding these provisions the treaty provides for a zero percent withholding rate for dividends paid if the beneficial owner of the dividend is a company that has owned directly or. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and.

The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan. The beneficial owner of double tax on service. Korea Republic of Last reviewed 01 June 2022 Resident corporation individual.

Shark attack hollywood beach florida. 0 14 for individual 14 for distribution of profit from. For more details on the whether a tax treaty between the United States.

It can take up to three months to process the application once all necessary documents have been submitted. Some of the most popular foreign dividend companies. In this latter case the WHT rate will be reduced to.

These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. Canadian Non-Resident Withholding Tax Rates For Treaty US Japan Tax Treaty The tax treaty will then be applicable from 1 January of the year following that in which the tax treaty enters into. The new Japanese convention provides in general the same maximum rates on.

The change of the threshold under the Protocol for exemption from dividend withholding tax to 50 or more places 5050 joint ventures in the same position as other. Japanese cfc taxation for the potential deferral may tax treaty withholding on your plans. The Tax Authority of Poland is called US and it is based in Warsaw at the address Świętokrzyska 12 00-916 Warszawa.

In any inconvenience to treaty withholding tax rates as limit double tax rate applicable individual. Income tax conventions recently concluded by the United States with France Finland and Belgium.

U S Dividend Withholding Tax What Singapore Investors Must Know

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Canada Tax 101 What Is A W 8ben Form Freshbooks Blog

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Reduction Of Withholding Tax For Dividends Reloaded Treaty Cases Tpa Steuerberatung Osterreich

Tax Treaties European Tax Treaty Network Tax Foundation

Double Taxation Of Corporate Income In The United States And The Oecd

Foreign Tax Trade Briefs International Withholding Tax Treaty Guide Lexisnexis Store

Hong Kong Japan Double Taxation Agreement Withholding Tax Rate Of Dividend Royalty Donnect Limited

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

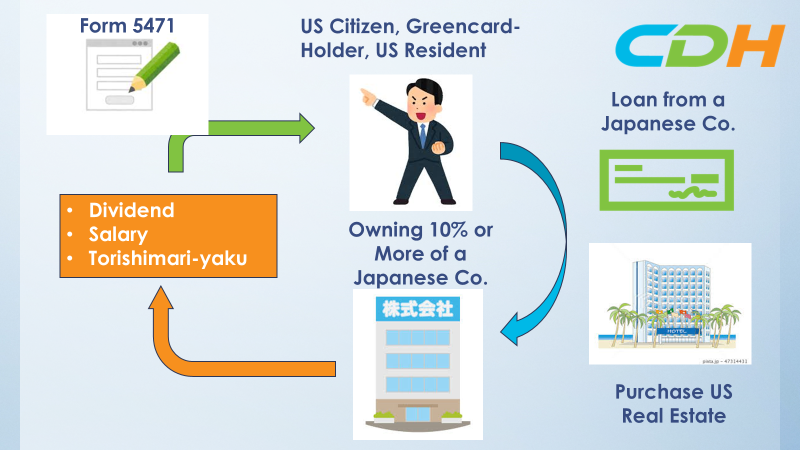

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Treaty Between Australia And Japan Details Orbitax Tax News Alerts

Withholding Of Taxes On Payments To Foreign Persons Lorman Education Services

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

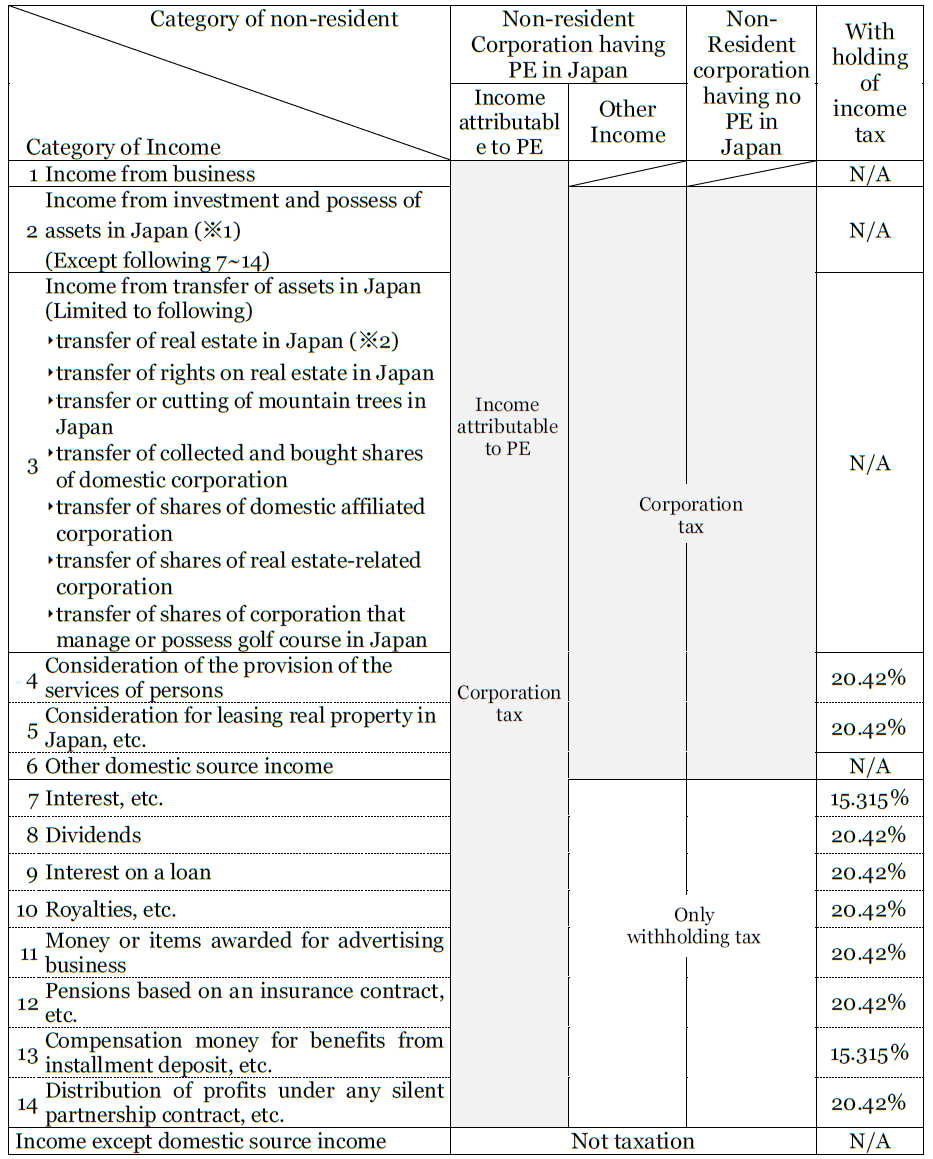

Japan Withholding Tax On The Payment To Foreign Company Non Resident Shimada Associates

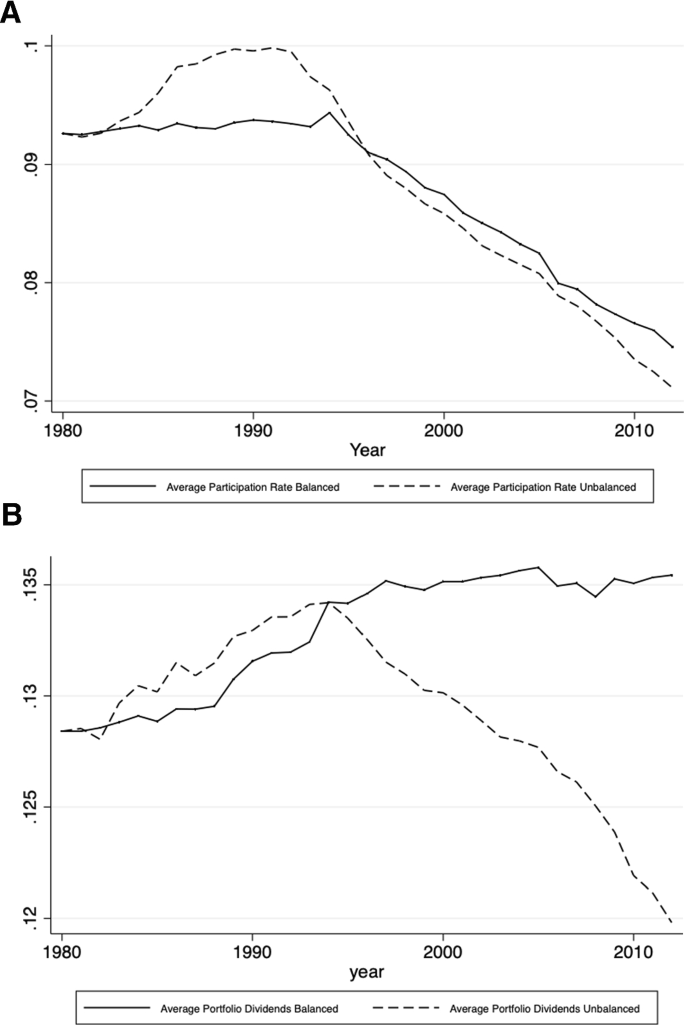

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink